The SEC’s Office of Investor Education and Assistance is issuing this Investor Bulletin to educate investors about how fees you pay for investment services and products can impact the value of your portfolio.

Fees and Expenses Reduce Your Investment Returns

As with anything you buy, there are fees and expenses associated with investment products and services. These fees may seem small, but over time they can have a major impact on your investment portfolio. This is because fees and expenses reduce the amount of money in your investment portfolio earning a return.

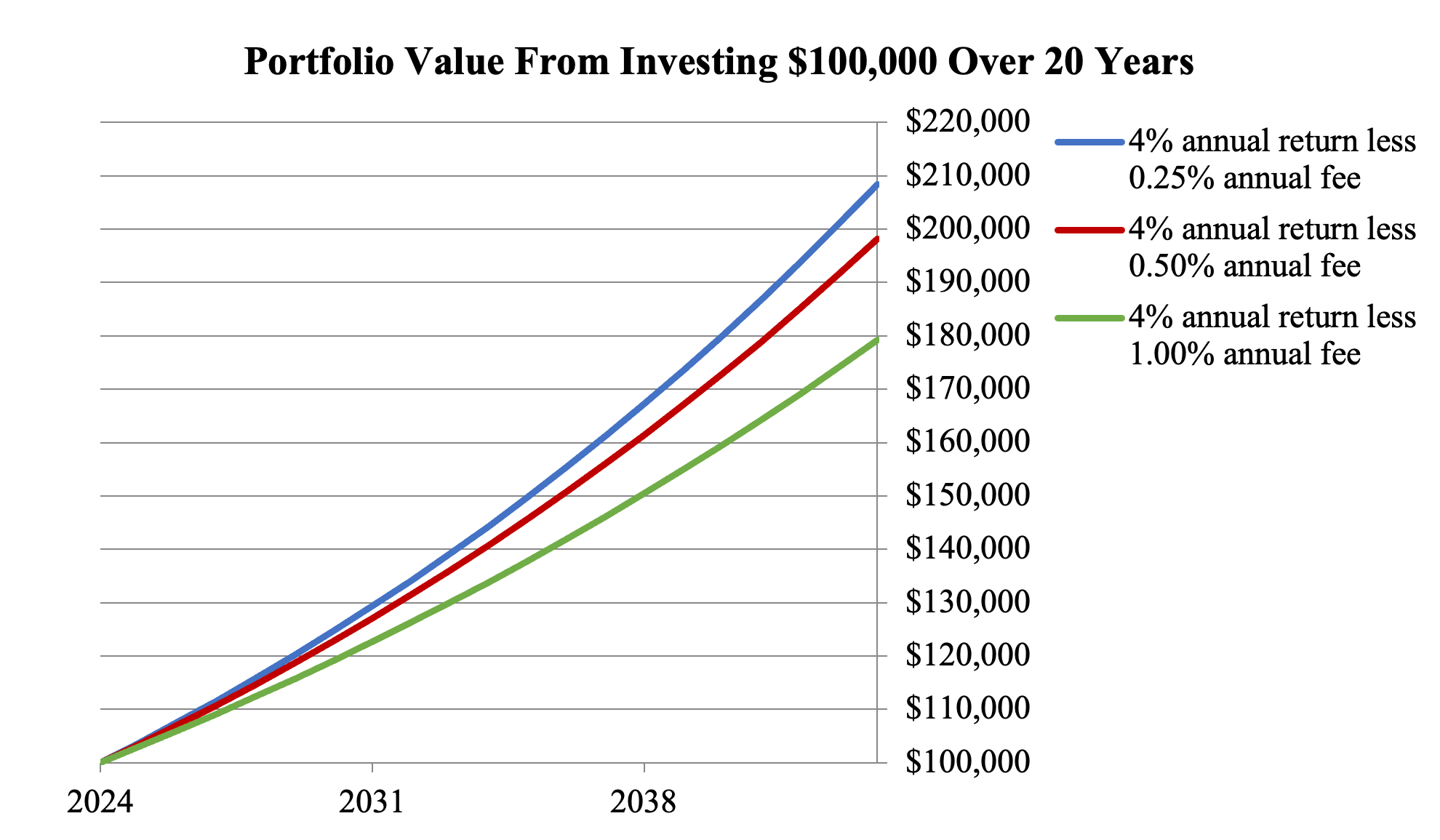

The following chart shows the impact of three different fees on a $100,000 investment that grows 4% annually over 20 years. Notice how the different fees affect the value of the hypothetical investment portfolio.

- The blue line represents the investment portfolio with an annual fee of 0.25%. At the end of 20 years, the portfolio would be worth approximately $208,000.

- The red line represents the investment portfolio with an annual fee of 0.50%. At the end of 20 years, the portfolio would be worth approximately $198,000.

- The green line represents the investment portfolio with an annual fee of 1.00%. At the end of 20 years, the portfolio would be worth approximately $179,000.

Fees impact your investment, so it’s important you understand them. When choosing an investment professional or an investment, be sure you understand and compare the fees you’ll be charged. It could save you a lot of money in the long run.

How do I know what I’m being charged?

Read key disclosures. Find out what you will be charged by reading the disclosure documents. You can typically find them online or request paper versions.

- For investment professional fees:

- Account opening documents

- Form CRS (also called the client or customer relationship summary)

- Regulation Best Interest (“Reg BI”) disclosures if you are a brokerage customer

- Form ADV if you are an advisory client

- Fee schedules

- Your account statements and trade confirmations

- For investment product fees:

- Form CRS

- Prospectuses (the prospectus of a mutual fund or exchange-traded fund (ETF) contains a standardized table of fees and expenses)

- Shareholder reports

- Other offering documents (for example, a private placement memorandum)

Ask questions. Make sure to ask your investment professional to explain all of the fees you will pay. Even if you can’t readily identify separate fees, you typically pay fees. Investing isn’t free. See below for some suggested questions to ask about the account and product fees you will pay, and how your investment professional gets paid.

Check your statements. Review your confirmation and account statements to be sure you’re being charged correctly. Ask your investment professional to break the fees down for you if it’s unclear.

What types of fees are there?

Fees typically come in two types—transaction fees and ongoing fees. Both types of fees reduce the overall amount of money in your investment portfolio. Some investment products or services – including mutual funds, ETFs and variable annuities – commonly include both transaction and ongoing fees.

Transaction fees. Transaction fees are charged each time you buy, sell or exchange an investment—for example, when you buy a stock or mutual fund share. Examples of transaction fees include:

- Commissions. You will often pay a commission when you buy or sell a security through an investment professional. The commission compensates the investment professional and his or her firm when it is acting as an agent for you in your securities transaction.

- Markups/Markdowns. When a broker-dealer buys from or sells to you securities it holds in its own inventory, the broker-dealer acts as a principal in the transaction. When acting as a principal, the broker-dealer generally will be compensated by selling the security to you at a price that is higher than the market price (the difference is called a markup), or by buying the security from you at a price that is lower than the market price (the difference is called a markdown).

- Sales loads. Some mutual funds charge a fee called a sales load, which compensates the investment professional for selling the mutual fund shares to you. Sales loads can be front-end in that they are paid at the time you make your investment, or back-end in that you pay the fee when you sell the mutual fund shares, usually within a specified timeframe. For more information, see Mutual Fund and ETF Fees and Expenses – Investor Bulletin.

- Surrender charges. Early withdrawal from a variable annuity investment will usually result in a surrender charge. This charge compensates your investment professional for selling the variable annuity to you.

Ongoing fees. Ongoing fees or expenses are charges you pay regularly, such as an annual account maintenance fee, even if there are no transactions in your account. Over time, even small ongoing fees have a big impact on your investment portfolio. Examples of ongoing fees include:

- Investment advisory fees. If an investment adviser manages your investment portfolio, they may charge you an ongoing annual fee based on the value of your portfolio. As shown in the graph above, the amount of the fee can have a big impact on your return.

- Annual operating expenses. The expenses of managing and marketing mutual funds, ETFs, and other funds are often passed on to the investors as indirect fees. This means the fees are deducted from the fund’s assets and therefore lower your investment returns. These fees are often charged as a percentage of the fund’s assets (the fund’s expense ratio) and are identified in the fund’s prospectus as the annual fund operating expenses.

- Retirement plan fees. The expenses for operating and administering a retirement plan, such as a 401(k) or 403(b), may be passed along to its participants. This is in addition to the expenses of the underlying investments that you may hold in your plan (e.g., annual operating expenses of mutual funds).

- Annual variable annuity fees. If you invest in a variable annuity, you may be charged fees to cover the expenses of administering the variable annuity. You also may pay fees such as insurance fees and fees for optional features (often called riders). You will also be subject to the annual operating expenses of any mutual funds or other investments the variable annuity holds.

What other fees might I pay?

You might pay other fees that are not obvious to you. For example:

- Other brokerage fees. In addition to commissions, a broker-dealer may charge certain other fees, such as fees for: use of certain trading platforms, account maintenance, account inactivity, not maintaining a minimum balance, account transfers, account closings, or wire transfers. These fees may not always be obvious to you from your account statement or confirmation statement. Read the fee schedule or other fee disclosure and ask questions to understand all the fees you are charged and why.

- Other investment product fees. When it comes to ETFs, for example, there may be additional transaction fees and costs not identified in the fund’s prospectus. For more information, see Mutual Fund and ETF Fees and Expenses – Investor Bulletin.

What questions can I ask to help understand the fees I will pay?

To further understand what you will be charged, consider asking the following questions about account-level and product-level fees and how your investment professional gets paid.

Account fees:

- Is this a brokerage or advisory account? Will I typically be charged fees on a transaction-by-transaction basis (brokerage) or will I instead be charged a recurring fee based on the total amount of assets in my account (typically advisory)?

- What fees will I pay relating to this account either directly or indirectly? Do you have a fee schedule that lists all of the fees that will be charged for investments and maintenance of this account?

- How can I reduce or eliminate some of the fees I’ll pay? For example, can I buy the investment directly from the issuer without paying an investment professional? Can I pay lower fees if I open a different type of account?

- Do I need to keep a minimum account balance and/or stay invested for a minimum period of time to avoid certain fees?

- Are there any other transaction or advisory fees? Account transfer, account inactivity, wire transfer fees, or any other fees?

Product fees:

- What fees will I pay to purchase, hold, and sell this investment? Will those fees appear on my account statement or my confirmation? If not, how will I know about them?

- Are there penalties or other fees imposed if I sell or surrender a product, such as an annuity, earlier than I expected when I purchased it?

- How do the fees and expenses of the product compare to other products that can help me meet my investment objectives?

- Does the product have more than one share class? If so, how do the fees compare across share classes? What is the overall lowest cost share class available and how do I qualify for that share class? Are there discounts available if I invest a certain amount of money in a particular share class?

- How much does the investment have to increase in value before I break even?

Investment professional compensation:

- How do you get paid? By commission? How are commissions determined? Based on the amount of assets you manage? Does your fee vary depending on the amount of assets you manage for me?

- Do you get paid through means other than through commissions and a fee based on the amount of assets you manage and, if yes, how?

- Do you get paid differently if I invest in different investment products? Do you make more/less money if I invest in different investment products?

- Do you get paid even if you do not make changes to my investments?

- Do I have any choice on how to pay you?

What can I do if I think my fees are too high?

- Follow up. If your fees seem too high, ask questions. Consider following up in writing if you are not satisfied.

- Negotiate. In some cases, fees are negotiable. Talk to your investment professional about reducing them.

- Shop around. Just like shopping around for the best price on any other product or service, you should consider how much you are paying for investing services. You can use FINRA’s Fund Analyzer to compare the fees and other costs of certain types of securities, including mutual funds and ETFs. If you are considering moving to a new firm or investment professional, or switching the type of account you have, think about any tax consequences and fees for closing or transferring your account; for example, if you have to sell some or all of your current holdings in order to transfer.

- Report. If you still feel there is a problem with your fees, report your concern to the SEC, FINRA, or the North American Securities Administrators Association (NASAA). There might be a problem with your fees if, for example, you are charged more than the agreed upon fees or there are signs of excessive trading in your account.

SEC Enforcement Actions. The SEC routinely brings enforcement actions involving fees and costs incurred by investors. Here are some examples of cases the SEC has settled:

- Wells Fargo Settles with SEC for Charging Excessive Advisory Fees

- SEC Orders Affiliated Investment Advisers to Repay Clients for Failing to Disclose Conflicts and Duty of Care Violations

- SEC Charges Investment Adviser with Failing to Disclose Conflicts and Orders It to Repay Harmed Clients

- SEC Charges TIAA Subsidiary for Failing to Act in the Best Interest of Retail Customers

- SEC Charges Broker-Dealer and Two Registered Representatives with Violations of Regulation Best Interest for Excessive Trading in Customer Accounts

Check the background and registration status of anyone recommending or selling an investment by using the SEC’s free Check Out Your Investment Professional search tool on Investor.gov. For more information, see How to Use the Investment Professional Search Tool on Investor.gov.

Additional Information

Mutual Fund and ETF Fees and Expenses – Investor Bulletin

Investor Bulletin: Brokers' Miscellaneous Fees

Investor Bulletin: Investment Adviser Sponsored Wrap Fee Programs

Investor Bulletin: How to Select an Investment Professional