Serving America’s Veterans by Providing Tips on Investing for the Future

By Lori Schock, former Director of the SEC’s Office of Investor Education and Assistance. This document is no longer being updated and may include information that is out-of-date. However, the content may be useful background information or provide historical perspective.

As a veteran, you have served to protect America’s liberties and freedoms. At the SEC, we want to serve you and help you protect your own financial freedom by providing you with valuable information and resources on investing for your future.

Whether you’re a recent veteran, a long-time veteran or somewhere in-between, there are important saving and investing decisions to be made. The SEC has a website for those who served, Investor.gov/veterans, that can help you through the various stages of your saving and investing journey.

Start Early! Set Goals and Create a Plan

First things first. Before you invest, check out the free tools and resources on Investor.gov. Here’s a sample of our resources:

- If you’re new to investing, check out our Introduction to Investing page.

- If you plan on using an investment professional, check their background on Investor.gov where you can learn about their employment history, registration status and more.

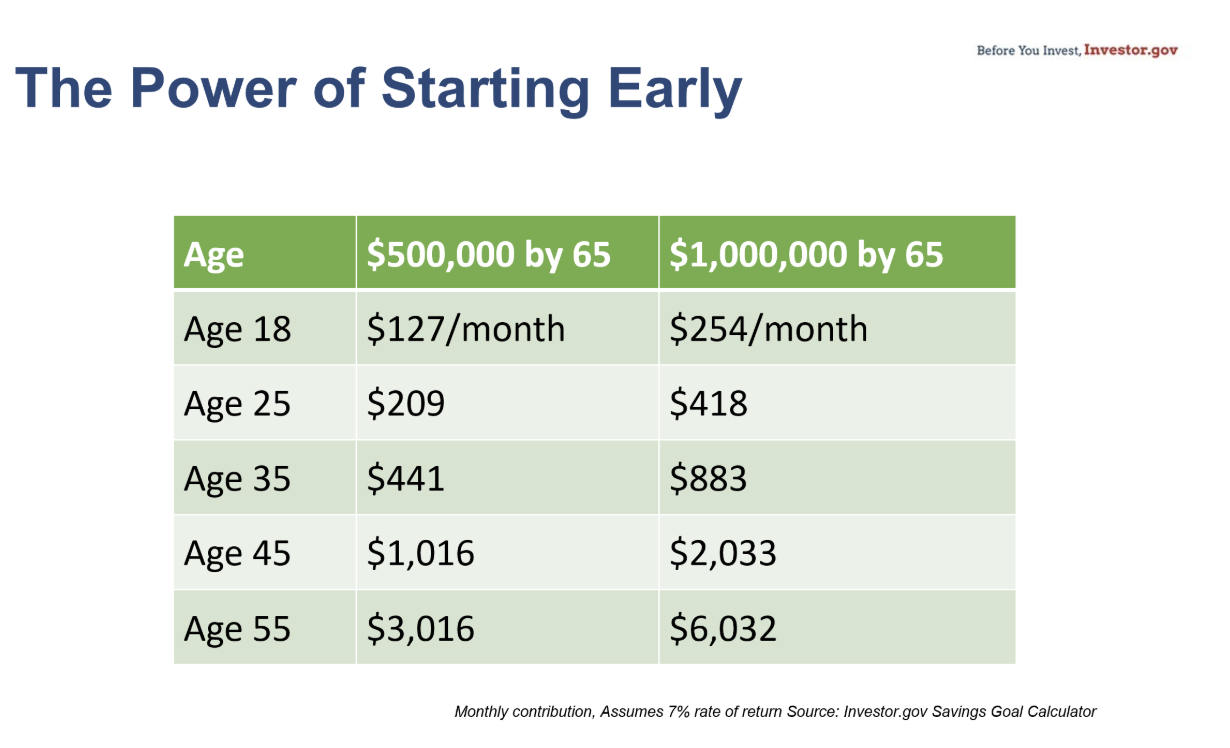

- You can use our free Financial Planning Tools and Calculators to help determine how much money you need to save each month to meet your financial goals and plan for retirement.

Setting goals, creating a financial plan, and saving and investing over a long-period-of-time will help put you on a path toward building a strong financial future. Think about what you want to save for in life−a house, college, an emergency fund, vacation−decide your priorities and plan accordingly. If you receive military or veteran benefits or other payments in a lump sum, we have guidance on the steps you can take to make the most of your lump sum payment.

When creating your financial plan, you should also consider paying off any high-interest debt. For example, the interest rate on credit cards is often far higher than the returns you can expect from your investments. No investment strategy pays off as well as, or with less risk than, eliminating high-interest debt.

Take Advantage of Employer-Sponsored Retirement Plans and Free Money

Another key aspect of planning for a sound financial future is building your retirement nest egg. Workplace retirement plans, like the Thrift Savings Plan (TSP) or a 401(k), are one of your best options for retirement savings since they offer diversified investments, low fees and tax advantages. Employers often match contributions you make to the plans. Don’t leave money on the table. Take advantage of any “free money” in your employer’s plan.

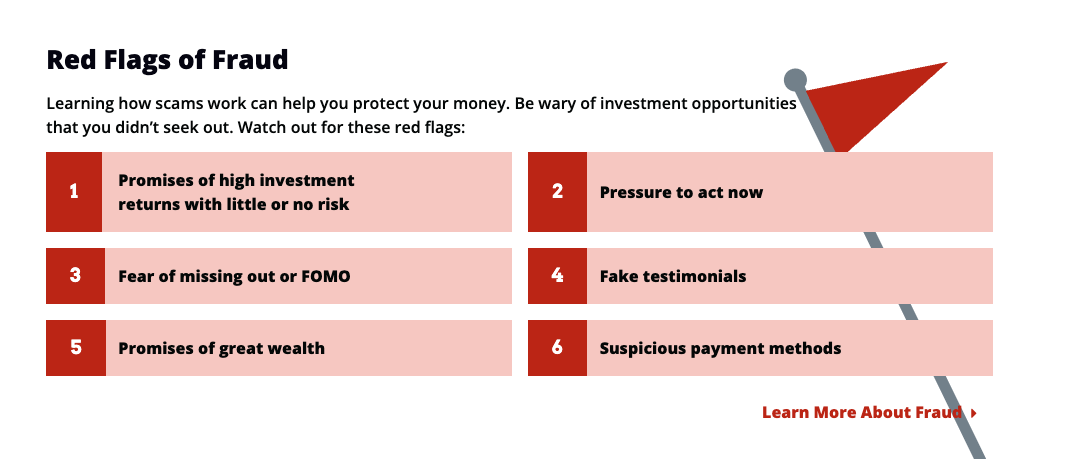

Stay Alert to Fraud Targeting Veterans

Protecting your money is another important part of your investment plan. Scammers often try to gain the trust of a group of people with common backgrounds and interests. As a veteran, you may be a potential target for fraud. Some scammers may even be a veteran or at least pretend to be. Even if you know the person offering an investment opportunity, make sure you check their background at Investor.gov and conduct your own independent research on the investment. If a “so-called” investment professional tries to pressure you to invest in something right away, promises guaranteed high returns or urges you to pay for an investment with gift cards, credit cards or by sending money abroad, it’s a warning sign of fraud. Remember, if it sounds too good to be true, it probably is.

Sign up for our Investor Alerts and Bulletins to get valuable information on ways to help you spot fraud and steer clear of con artists and their investment scams.

For example, we have an Investor Bulletin on Saving and Investing for Veterans.

Director’s Take Articles Geared to Helping You and Your Family

Director’s Take articles are intended to provide tips and information on a variety of investment topics, including several that are geared specifically to military service members, veterans and their families. Check out the various articles:

- Veterans: Protect Yourself From Becoming a Target for Investment Fraud

- Military Service Members “Immediate Actions” for Financial Success

- Basic Training Tips to Help Service Members Invest Wisely

- Military Spouses: Ensuring Financial Readiness on the Homefront

We’re Here For You

You have always been there for us, let us be there for you. Throughout the year, we conduct investor education presentations at military bases, VA installations and veterans organizations. If you know of an organization interested in receiving one of our presentations, please let us know by contacting us at outreach@sec.gov. If you have any questions about investing or want to report a complaint, call the SEC’s toll-free investor assistance line 800-732-0330 (dial 1-202-551-6551 if calling from outside of the United States) or email Help@SEC.gov. You can submit tips, complaints and referrals about possible investment scams and securities frauds at www.sec.gov/tcr.

Thank you for your service to our country.

Note: Director’s Take articles are written in a short, non-legalese format intended to provide you with tips and information on timely investment topics that are important to you. You can subscribe to receive Director’s Take articles or find our latest article on the Director’s Take spotlight page.