The SEC’s Office of Investor Education and Assistance (OIEA) and Division of Enforcement warn investors that scams involving stock recommendations may be conducted through social media. Investors should never make investment decisions based solely on information from social media platforms or apps.

Watch Out For Stock Tip Red Flags.

Did you click on an advertisement online or on social media, and get added to a group chat focusing on investments?

Has someone contacted you through social media claiming they are a famous investment professional or an employee of a registered investment adviser or registered broker?

Have you been promised high investment returns with little or no risk?

Protect Yourself. If you experience any of these red flags, take the time to research and verify by following these steps:

✓ Always check the background of someone offering you an investment and be aware that fraudsters may impersonate registered brokers or investment advisers on social media. You can use the free tool on Investor.gov to check out the background, including registration or license status, of any firm or investment professional. We urge investors to work only with a currently licensed or registered investment professional or firm.

✓ Verify that you are communicating with an investment professional and not an imposter. For example, contact the professional using a phone number or website listed in the firm’s Client Relationship Summary (Form CRS). To ensure you are looking at a genuine copy of the firm’s Form CRS, follow these steps:

- In the “Check Out Your INVESTMENT PROFESSIONAL” search box on Investor.gov, select “Firm” from the drop down options and type in the name of the firm.

- In the search results, click on the relevant firm and then click on “Get Details.”

- Click on “Relationship Summary” or “Part 3 Relationship Summary.”]

If someone misrepresents that they are registered or impersonates a registered investment professional, report it to the SEC. To learn more, visit our Impersonation Schemes webpage on Investor.gov.

Stock Recommendations You Receive Through Social Media May Be Part of an Investment Scam.

You likely have seen ads online or on social media platforms that promise stock tips. Some of these ads may purport to be affiliated with a well-known individual in the finance and investing industry. They may promise astronomical investment returns, including 100 percent or more.

Guaranteed High Investment Returns. A promise of high investment returns – often accompanied by a guarantee of little or no risk – is a classic sign of investment fraud. Every investment has risk, and the potential for high returns usually comes with high risk. If it sounds too good to be true, it probably is.

When you click on one of these ads, you may get automatically added to a social media group chat. The next thing you know, you are messaging with someone who purports to be an “investment adviser” (and/or their “assistant”) and recommends that you buy shares of specific well-known companies.

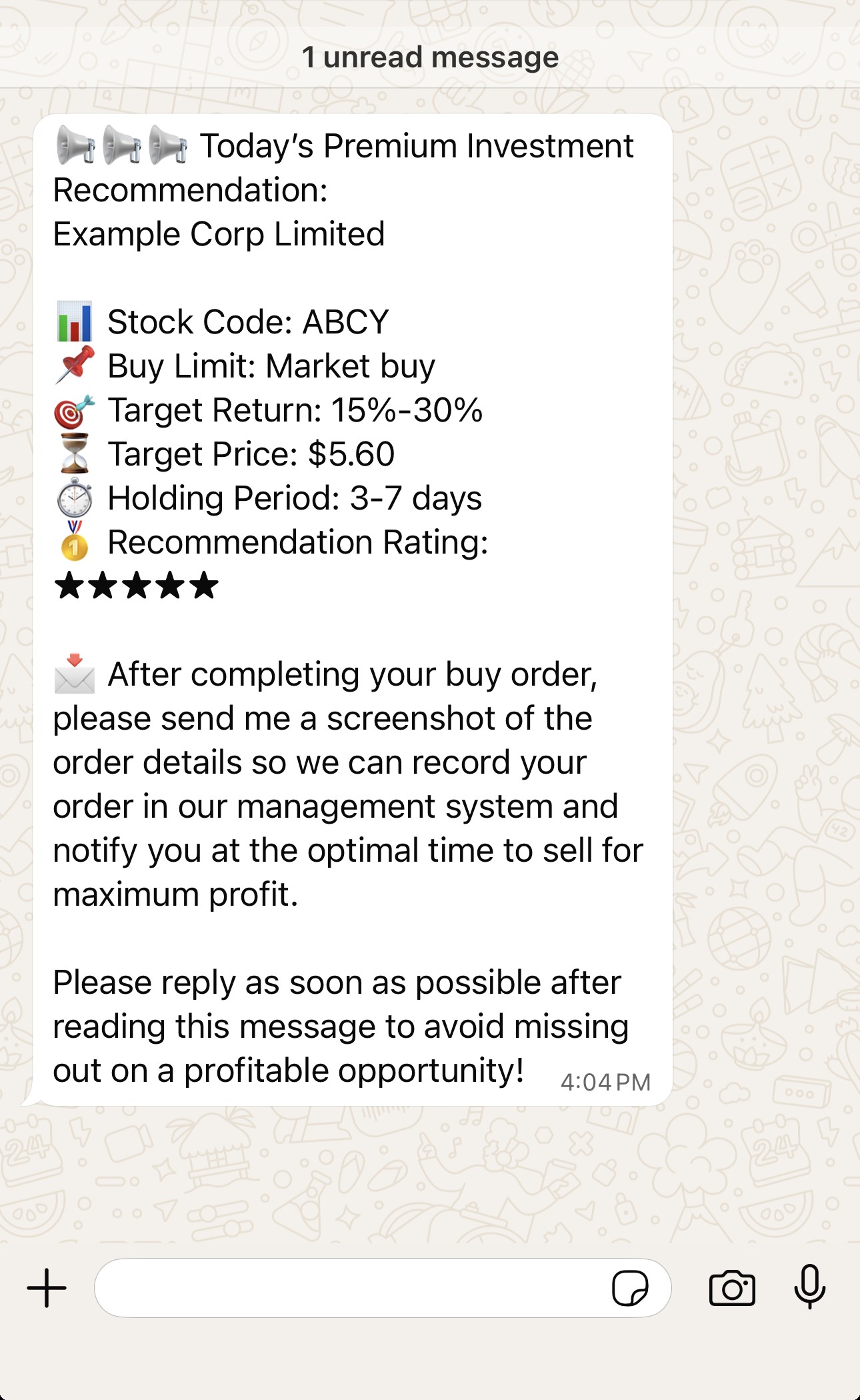

If you follow the recommendations and see returns on these investments, you may begin to gain a false sense of trust. Once the so-called investment adviser has your trust, you may be advised to purchase shares of relatively smaller companies (including companies listed on major U.S. stock exchanges) and to send screenshots of your purchases to the “adviser.” The next thing you know, the stock price plummets and you lose most of your investment.

SEC staff created the following mock promotion to show you the type of message you may receive in a real scam:

Fraudsters Can Manipulate a Stock’s Share Price to Profit at Your Expense.

Fraudsters can manipulate the share price of a company’s stock (either positively or negatively) by spreading rumors on social media. Fraudsters then profit at investors’ expense. For example, fraudsters may use social media to increase a company’s share price including through:

- Pump and dump schemes – pumping up the share price of a company’s stock by making false and misleading statements to create a buying frenzy, and then selling shares at the pumped up price.

- Scalping – recommending a stock to drive up the share price and then selling shares of the stock at inflated prices to generate profits.

- Touting – promoting a stock without properly disclosing compensation received for promoting the stock.

In other instances, fraudsters start negative rumors urging investors to sell their shares so that the stock price plummets and then the fraudsters take advantage by buying shares at the artificially low price.

Fraudsters may promote a stock or spread negative rumors about a stock through social media anonymously or while pretending to be someone else. Fraudulent stock promotions on social media can take various forms, including memes.

SEC Enforcement Actions. In the last year, the SEC has temporarily suspended trading in the stock of 13 small-cap Asia-based companies in which investors received stock recommendations – from unknown persons via social media – that appeared to be designed to artificially inflate the price and volume of the stock:

- QMMM Holdings Limited (Nasdaq: QMMM)

- Smart Digital Group Limited (Nasdaq: SDM)

- Etoiles Capital Group Co., Ltd (Nasdaq: EFTY)

- Platinum Analytics Cayman Limited (Nasdaq: PLTS)

- Pitanium Limited (Nasdaq: PTNM)

- Empro Group Inc. (Nasdaq: EMPG)

- NusaTrip Incorporated (Nasdaq: NUTR)

- Premium Catering (Holdings) Limited (Nasdaq: PC)

- Robot Consulting Co., Ltd. (Nasdaq: LAWR)

- Charming Medical Limited (Nasdaq: MCTA)

- Magnitude International Ltd (Nasdaq: MAGH)

- JM Group Limited (NYSE: JMG)

- TechCreate Group Ltd. (NYSE: TCGL)

Market Manipulation is Not Limited to Microcap Stocks.

While microcap stocks (some of which are penny stocks and/or nanocap stocks) tend to be more susceptible to market manipulation, pump and dump schemes are not limited to microcap stocks. When it comes to stock recommendations you receive through social media, do not let your guard down because the company is listed on a major U.S. stock exchange.

Additional Information

Group Chats as a Gateway to Investment Scams – Investor Alert

FINRA Investor Alert: Social Media ‘Investment Group’ Imposter Scams on the Rise

Social Sentiment Investing Tools —Think Twice Before Trading Based on Social Media

Report possible securities fraud to the SEC.

Ask a question or report a problem concerning your investments, your investment account or a financial professional.

Visit Investor.gov, the SEC's website for individual investors. Receive Investor Alerts and Bulletins from OIEA by email or RSS feed.