The SEC’s Office of Investor Education and Advocacy and Office of Credit Ratings are issuing this Investor Bulletin to educate investors about credit ratings.

If you invest in bonds, you have probably come across credit ratings. Credit ratings usually appear in the form of alphabetical letter grades (for example, ‘AAA’ and ‘BBB’) and are an estimate of the relative level of credit risk of a bond or a company or government. Credit ratings are issued by third parties and are not an assessment by the issuer or the SEC.

Credit ratings can be useful when evaluating an investment. But when considering credit ratings, you should understand their limitations. You should not base your investment decision solely on a credit rating or treat a credit rating as if it were investment advice.

What is a credit rating?

A credit rating is an assessment of an entity’s ability to pay its financial obligations. The ability to pay financial obligations is referred to as creditworthiness. Credit ratings apply to debt securities like bonds, notes, and other debt instruments (for example, some asset-backed securities). Credit ratings also are assigned to companies and governments. They do not apply to equity securities like common stock.

A credit rating agency assesses the creditworthiness of an entity that is usually called an obligor or issuer. Obligors include entities such as corporations, financial institutions, insurance companies, or municipalities.

Credit ratings generally reflect a relative ranking of credit risk. For example, an obligor or debt security with a high credit rating is assessed by the credit rating agency to have a lower likelihood of default (that is, not paying back its debt) than an issuer or debt security with a lower credit rating.

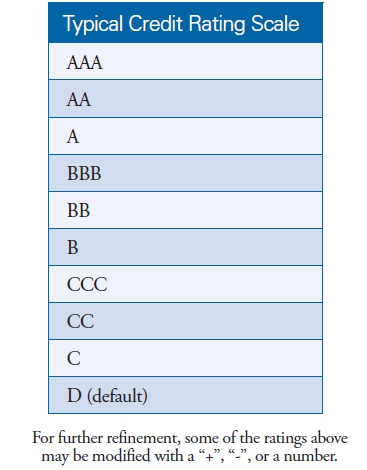

Credit rating agencies use rating scales, symbols, and definitions to express credit risk. Most use a scale of letters and/or numbers, and these symbols are defined by the particular credit rating agency issuing those ratings. A typical credit rating scale, as shown in the table below, has a top rating of ‘AAA’ and may have a lowest rating of ‘D’ (indicating default). Some credit rating agencies’ scales distinguish between investment grade and non-investment grade (i.e., “speculative” or “high yield”) ratings and they draw this distinction between the ‘BBB’ and ‘BB’ rating categories (in other words, a rating that is ‘BBB-’ or higher is investment grade and a rating that is lower than ‘BBB-’ is non-investment grade).

What a credit rating is not

A credit rating does not reflect other types of risk, such as market or liquidity risks, which may also affect the value of a security. Nor does a credit rating consider the price at which the security is offered or sold. You should not interpret a credit rating as investment advice and should not view it as a recommendation to buy, sell, or hold securities.

A credit rating is not a guarantee that a financial obligation will be repaid. For example, an ‘AAA’ credit rating on a debt instrument does not mean the investor will always be paid—instruments rated at this level sometimes default.

Important considerations

A credit rating is an assessment of the creditworthiness of a debt instrument or obligor, based on a credit rating agency’s analytical models, assumptions, and expectations. A credit rating may reflect a credit rating agency’s subjective judgment of an issuer’s business and management. While historical financial and operating experience and collateral performance may factor into the analysis, credit ratings are simply a prediction of the likelihood that an obligor will repay the obligation in the future. The predictions are based on the views of the credit rating agency, which may differ from your view and those of other industry participants.

Credit rating changes can happen at any time, without warning, and at any rating level. Some credit rating agencies provide rating “outlooks” and rating “watches” to formally alert investors about potential revisions to those ratings. Even still, these alerts may not precede every rating action.

You should understand the information that credit ratings are intended to convey and any limitations to the ratings. You should also evaluate the bond’s prospectus or other documents that provide financial information, industry news and reports, and non-credit-related factors to determine whether an investment is suitable for you. Consider seeking professional advice, particularly if you have questions about analyzing the information.

About Credit Rating Agencies

Some credit rating agencies are registered with the SEC. Credit rating agencies registered with the SEC are referred to as nationally recognized statistical rating organizations (“NRSROs”). Generally speaking, the larger credit rating agencies issue credit ratings across industry sectors and around the world, while some smaller credit rating agencies focus on specific types of ratings. You can find out whether a credit rating agency is registered with the SEC by visiting the SEC’s website at www.sec.gov/ocr. Importantly, SEC registration is not an endorsement of a credit rating agency nor any credit rating issued.

The SEC oversees and examines NRSROs. By law, however, the SEC is not permitted to regulate the substance of credit ratings or the procedures and methodologies the NRSROs use to determine credit ratings. Methodologies include, among other things, the quantitative and qualitative models used to determine credit ratings.

Each NRSRO is registered with the SEC in up to five possible credit rating classes. These credit rating classes are: (1) financial institutions; (2) insurance companies; (3) corporate issuers; (4) asset-backed securities; and (5) government securities.

Potential conflicts of interest in credit ratings

Many credit rating agencies—including the largest agencies—are paid by the obligors they rate or by the issuers of the securities they rate. This creates a potential conflict of interest in that the credit rating agency may be influenced to determine more favorable (i.e., higher) ratings than warranted to retain the obligors or issuers as clients and to obtain new obligor or issuer clients.

Alternatively, some credit rating agencies are paid by subscribers to their ratings services, which are usually investors. Investors’ desire for low or high credit ratings, depending on their holdings and trading positions, may also present a conflict of interest.

NRSROs are required by law to disclose these potential conflicts of interest. NRSROs are also required to establish, maintain, and enforce written policies and procedures to address and manage these potential conflicts of interest.

Where can you find credit ratings and related information?

Many credit rating agencies make their ratings available to the public on their websites and with market data providers. Others require subscriptions to access their credit ratings. Your financial adviser may also have access to this information.

All NRSROs are required to provide on their public websites a description of their credit rating scales and definitions and the methodologies they use to determine their ratings. Credit rating agencies may require subscriptions or fees to obtain narrative reports containing credit analysis, although some credit rating agencies make these reports available for free.

Why do investors use credit ratings?

When making investment decisions, credit ratings and any related rating and industry trend reports can be helpful tools, provided you use them appropriately. Credit ratings may offer an alternative point of view to your own financial analysis or that of your financial adviser.

Credit ratings may enable you to compare risks among investments in your portfolio. Considering the credit ratings of multiple credit rating agencies may be useful because they may offer diverse views on the creditworthiness of an investment.

In general, if you use credit ratings, they should be in addition to, and not a replacement for, your own research, analysis, and judgment to determine whether an investment best satisfies your needs. Remember that credit ratings address credit risk only. They do not address other risks such as liquidity risk, interest rate or market risk, or prepayment risk. The bottom line is that you should know what you are buying and only invest in what you understand.

Credit ratings are subjective

There are no standard or agreed-upon methods to measure the accuracy of credit ratings. This is partly because of the subjective nature of credit ratings. Also, the performance of credit ratings may not be comparable across different industry sectors, meaning that defaults and rating changes (or “transitions” of an issuer’s or debt instrument’s rating from one rating to another) may not be consistent for each rating category across the sectors. For example, default rates for corporate bonds historically have been greater than default rates for municipal bonds with the same credit ratings.

Even within an industry sector, transition and default rates may differ over time and in different geographic regions. Inconsistencies in performance can be attributable to changes in business cycles and economic environments that do not impact all obligors equally and at the same time.

In terms of comparing credit ratings performance across credit rating agencies, you should know that definitions for what their credit ratings mean differ among credit rating agencies. Credit rating agencies also use different analytical approaches and levels of subjectivity when determining credit ratings.

Credit rating agencies may differ in the time horizon that their ratings address. For example, some credit rating agencies aim for stability in ratings so they assume a longer term horizon in their analysis. Other credit rating agencies prefer to address short-term risks and events, which can lead to more variability in their ratings. Additionally, some credit rating agencies’ ratings only reflect the likelihood that an obligor will default, while others’ ratings also consider the expected loss that may result from a default.

Credit rating agencies registered with the SEC are required each year to post on their websites performance statistics and the history of their credit ratings for their registered rating classes. The performance statistics show transition and default rates for the classes of ratings. Investors can also use these statistics to assess the stability, or volatility, of credit ratings within and among fixed income sectors.

Additional Information

SEC Investor Bulletin: Municipal Bonds: Understanding Credit Risk

SEC Investor Bulletin: What Are Corporate Bonds?

SEC Investor Bulletin: What Are High-yield Corporate Bonds?

SEC Investor Bulletin: Focus on Municipal Bonds

The Office of Investor Education and Advocacy and the Office of Credit Ratings have provided this information as a service to investors. It is neither a legal interpretation nor a statement of SEC policy. If you have questions concerning the meaning or application of a particular law or rule, please consult with an attorney who specializes in securities law.